Everybody hates renters

Institutional investors in the housing market… here we go again

A note before today’s column.

Yesterday’s shooting in Minneapolis is another sign of this administration’s escalating authoritarianism. Not only did an ICE agent kill a woman at point-blank range, but senior officials immediately sprung into action to justify the killing of an American citizen.

Renee Nicole Good was 37 years old. She is survived by her 6-year-old child.

I wish I had something profound to say about this. Some advice or course of action that could make this right. But there really isn’t anything that can make this right. A woman is dead and her killer is free.

It can feel weird to talk about anything else other than the biggest story of the day, but the mission of The Argument is to engage in the most important debates that will define the policy and political direction of the alternative to Trump. And just a couple hours after Good was shot, Trump was posting online about his newest housing proposals.

People forget, but J.D. Vance was a key architect of the populist myth that BlackRock is the primary villain in the housing crisis.

On June 9, 2021, the then-candidate for Ohio Senate approvingly retweeted a right-wing anonymous Twitter account that went viral for the claim that “Blackrock is buying every single family house they can find, paying 20-50% above asking price and outbidding normal home buyers.”

Vance’s addition was to blame “The Left” for ignoring this problem because BlackRock was pro-DEI: “Woke capitalism: culture war against your values with one hand, robbing you blind with the other,” he tweeted.

The BlackRock myth1 spread quickly, culminating in yesterday’s announcement by President Donald Trump that he will be “taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it.”2 Like Vance, Trump blamed corporate ownership of housing for undermining young people’s ability to own a home.

The MAGA right are not the only group interested in this story. Left-leaning commentators and Democratic leadership also exhibited a bizarre fixation on institutional investors as a root cause of housing unaffordability. Not only is this false, but recent research indicates that institutional investors entering the housing market actually increase rental options and affordability (more on this later).

Institutional investors are a tiny fragment of the housing market

People often back up claims that BlackRock is buying up all the houses by citing statistics about “corporate investors,” a category that includes rich people who buy their vacation homes with an LLC and basically all landlords.

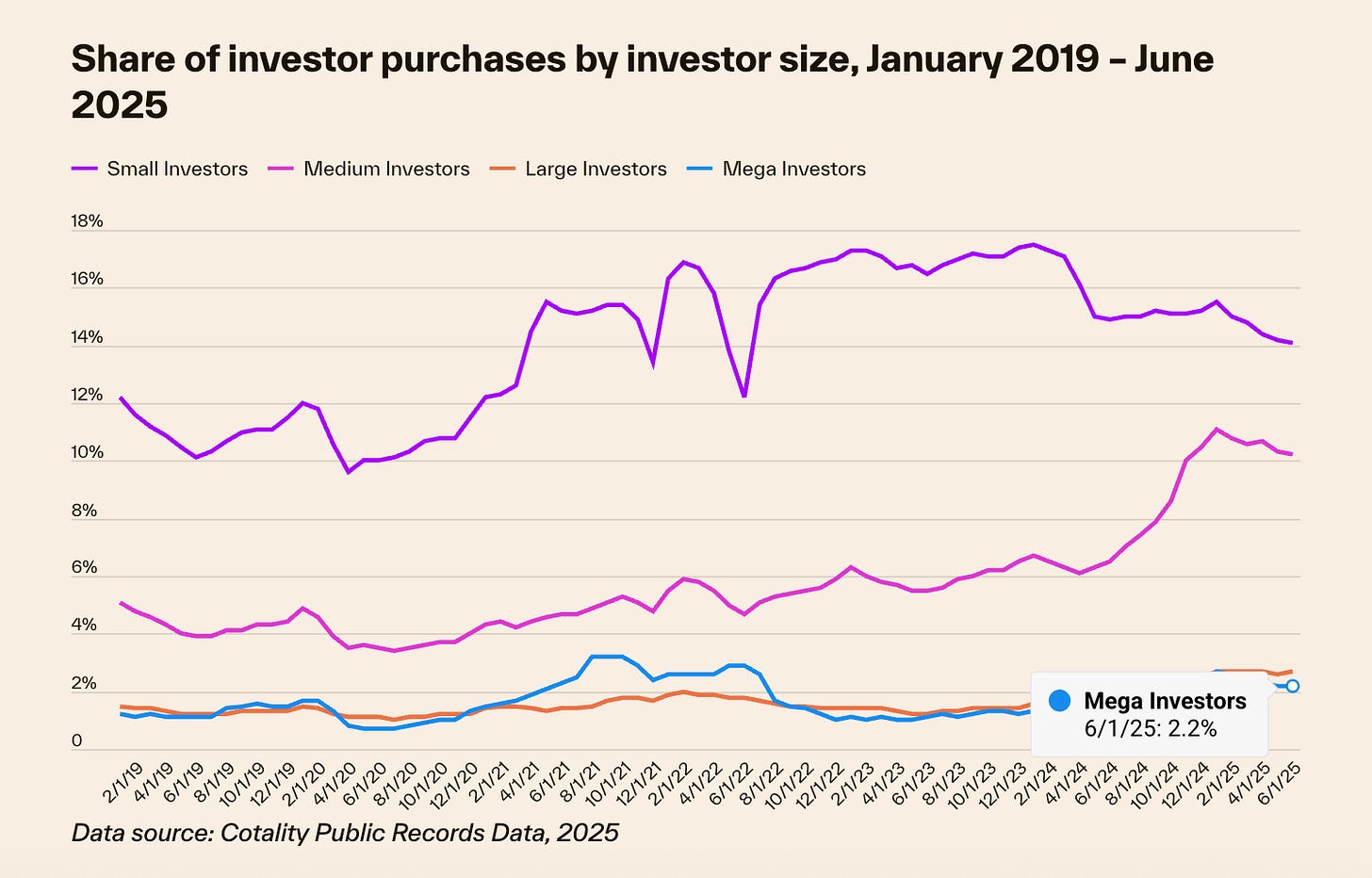

Cotality (formerly CoreLogic) tracks investor purchases by size, and at no point have large or mega investors (those owning hundreds or over 1,000 properties) constituted a significant share of the housing market. Notably, these are just purchases: At any given moment, the vast majority of homes are not for sale, meaning the share of homes investors own is even smaller. As you can see, purchases by mega investors have never even been 4% of total home purchases.

The most recent data I could find is unfortunately proprietary, so I can’t look at the underlying numbers myself, but a report by Yardi said that there are roughly 600,000 to 800,000 single-family homes owned by institutional investors. The last comprehensive study was done by the Urban Institute, which found that as of June 2022, large institutional investors (owning at least 100 homes) possessed 574,000 single-family rental properties. In 2022, there were more than 88 million detached single-family homes. That makes their ownership share roughly 0.65%.

The other important variable is that a significant share of the single-family homes owned by institutional investors are built-to-rent. That means these investors are not converting existing properties that are potentially available for sale to individuals, but creating totally new rental supply.

If you are interested in why home prices and rental prices have skyrocketed, why homeownership is lower than some people would like,3 or why homelessness has increased, it’s clear that none of those trends can be explained by a marginal actor that really only got on the scene between 2010 and 2013.

In which I get very annoyed at misleading research

Often when I trot out the above data, someone will make the reasonable point that housing markets are not only national but local and that it is possible that corporate concentration within a town, city, or neighborhood could be having deleterious effects in that community even if it cannot explain the bigger trends we’re usually worried about.

Recently, my former colleague at The Atlantic, Annie Lowrey, made this very case. In a piece titled “How Private Equity Is Changing Housing” she argues that “investor money is distorting the housing market in communities with low wages and decent-enough housing supply, pushing thousands of Black and Latino families off the property ladder.”